Published 12.03.2024

Digital Fundraising: How Swiss Startups & SMEs Benefit from Shares Tokenization

Discover how Swiss startups & SMEs benefit from digital fundraising through shares tokenization. Learn about the process and legal framework.

For Swiss startups and small to medium-sized enterprises (SMEs), securing capital is crucial for growth. However, they often encounter challenges with traditional capital raising methods, such as limited access to investor networks, complex issuance processes, and the absence of liquid secondary markets.

In response to these challenges, digital fundraising is simplifying and accelerating the way capital is raised. Utilizing blockchain technology, this process transforms company shares into digital tokens. These tokens serve the same function as traditional shares, representing ownership in the company but in a digital format, which eliminates the need for physical share certificates and manual transfer processes.

Key benefits of digital fundraising

This approach offers several advantages:

1. Digital and programmable equity: Shares transactions become instant, and smart contracts enable the automation of actions like dividend distributions or the enforcement of specific agreements, leading to significant savings for issuers.

2. Instant booking and settlement: Securities recorded on a digital ledger can be integrated with banking systems, enhancing the efficiency of transactions. Blockchain technology reduces the need for intermediaries, cutting down on costs.

3. Wider investor reach: Tokenizing shares breaks down the barriers that typically limit private equity investment to institutional investors, making it accessible to a more diverse group of investors.

4. Access to secondary markets: Enabling electronic trading allows issuers to offer liquidity to shareholders and employees, making shares more tangible and improving price discovery and transparency.

Switzerland's legal framework for share tokenization

Such advantages are made possible within a supportive legal framework. Since 2021, the Swiss regulatory framework has evolved to support digital fundraising fully. The clear legal environment, established by the adaptation of Article 973d-h CO, allows for the recognition of securities in an electronic format, facilitating the process of digital asset creation and exchange.

Complementing this, the Capital Markets and Technology Association (CMTA) provides the CMTA.Token standards (CMTAT), which offer guidelines for tokenizing securities in a manner compliant with Swiss laws. These standards ensure that all parties have a common understanding of the process, requirements, and expectations involved in issuing and trading tokenized securities.

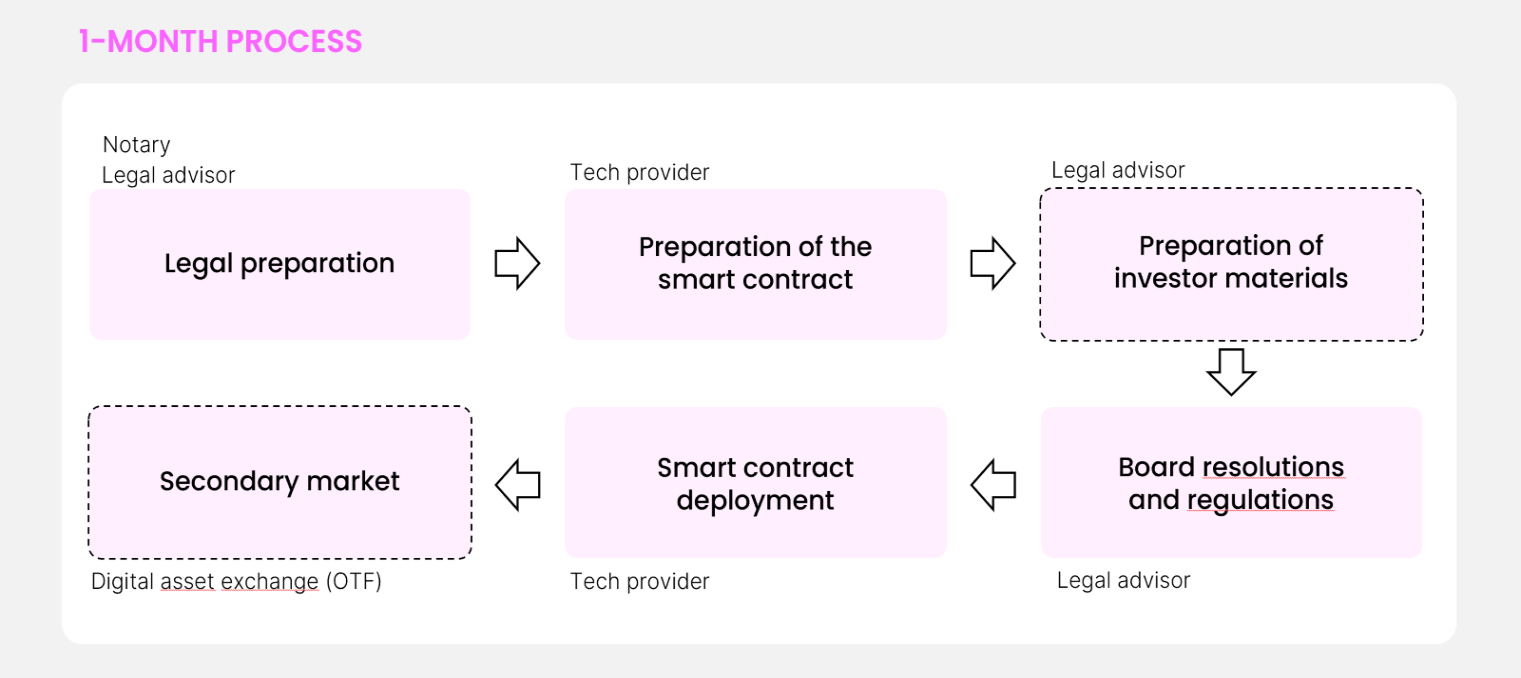

A step-by-step tokenization process for digital fundraising under Swiss law, leveraging the CMTA standard for tokenization of shares, can be summarized in the following steps:

1. Foundational legal framework: The company begins by revising its documents to acknowledge ledger-based securities, utilizing the CMTA's standards as a starting point. The board must then approve the tokenization approach and related protocols with reference to these guidelines.

2. Smart contract preparation: The company then moves to identify and select smart contracts that have been thoroughly audited and meet the regulatory criteria for ledger-based securities. The CMTAT standards set by Switzerland are applicable, but local regulatory frameworks should be applied where available. If no local standard exists, the CMTAT can act as a robust default. It’s critical to achieve endorsement from partnering financial institutions for the smart contracts.

3. Materials for investors: This stage is essential only if the company is actively seeking investment. The format and content of the materials will be uniform across different security types due to the technology-neutral stance of the regulations.

4. Board approval and legal compliance: Expanding on the initial legal preparations, the Board must formally agree on a resolution that approves the share tokenization, ensuring it aligns with both the company's articles and the relevant tokenization laws.

5. Entry to trading platforms: Taurus, a regulated securities firm supervised by FINMA, operates the TDX marketplace. To join this marketplace, issuers should start by setting up an account.

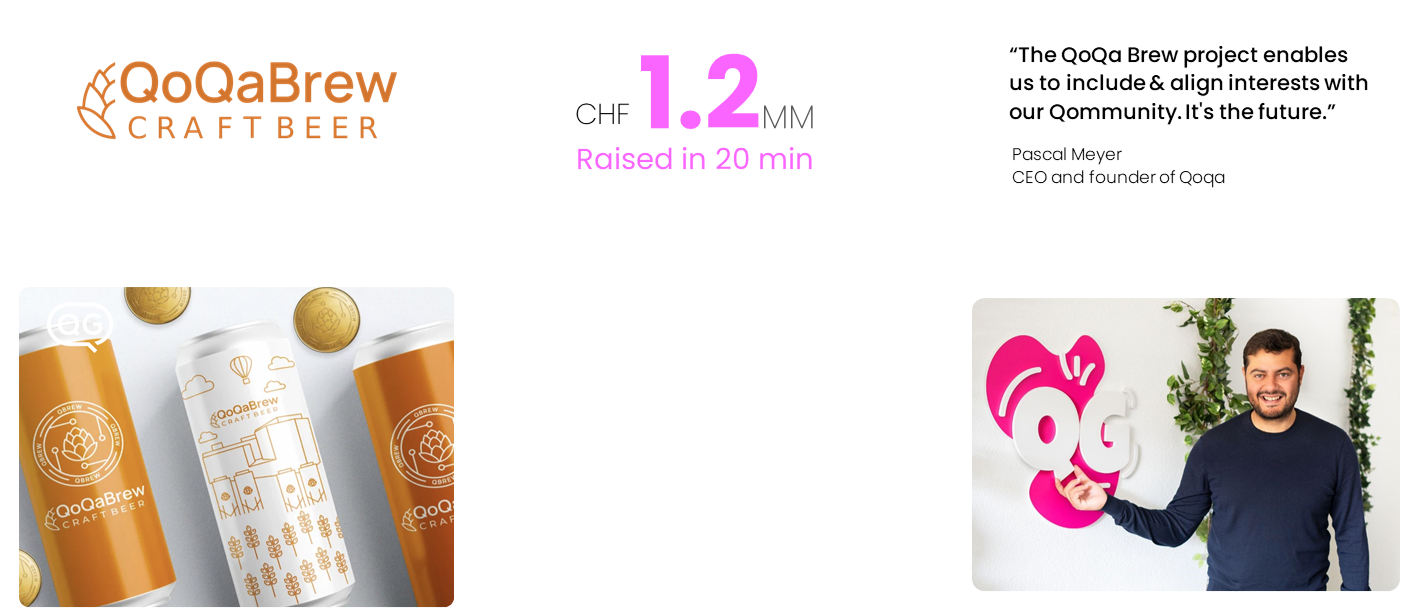

Case study: QoQa's digital fundraising with 2,500 investors

QoQa, a prominent Swiss e-commerce platform, demonstrates the successful application of share tokenization in enhancing capital raising efforts. Utilizing Taurus technology for the tokenization of its subsidiary's shares, QoQa significantly broadened its investor base and streamlined the fundraising process.

On May 20, 2022, the initiative resulted in a rapid capital raise of CHF 1.2 million from about 2,500 investors within 19 minutes. The company, which reported revenue of approximately USD 170 million in 2021 and boasts a customer base of 800,000, adhered to all necessary Swiss legal standards during this process, with legal advisory from Vischer law firm.

The tokenization facilitated by Taurus technology, including Taurus-CAPITAL for securities tokenization, Taurus-PROTECT for custody, and Taurus-EXPLORER for seamless share transfers, not only improved liquidity but also investor participation. Additionally, through the integration with TDX, QoQa's tokens could be traded openly, offering transparency and accessibility to investors.

Step-by-step implementation plan for digital fundraising

Drawing inspiration from success stories like QoQa's, here is a step-by-step roadmap example that Swiss startups and SMEs can follow to chart their course in digital fundraising.

Stage 1: START with digital shares & cap table

Begin by digitizing company shares and managing them with a digital cap table. This simplifies ownership tracking and makes the issuance process more efficient.

Stage 2: FUNDRAISE with a digital capital increase

Use the digital system for streamlined fundraising. Internally, this means easier share distribution among current investors or employees. Externally, it opens funding rounds to a wider investor pool, overcoming traditional barriers.

Stage 3: ENGAGE with a digital participation plan

Implement digital ESOPs to align employee interests with the company’s performance, incentivizing their contribution to growth. Establish a private marketplace for employees to buy and sell their shares, providing liquidity and a sense of ownership.

Stage 4: TRADE with TDX investors

Finally, make tokenized shares available for trading to professional and retails clients. This introduces new liquidity mechanisms that can be fully configured by the issuer, helping to reflect the company's valuation and growth potential.

With a robust framework already established, an increasing number of Swiss companies are considering this route for their capital raising needs. If you're interested in exploring what digital fundraising can do for your business, feel free to get in touch with our team.