Published 23.05.2024

SCCF and Taurus Announce Successful Tokenization of End-to-End Trade Finance Transaction on TDX Marketplace

SCCF and Taurus successfully tokenize a trade finance transaction on TDX Marketplace, marking a milestone in digital asset infrastructure for banks and institutions.

Geneva, 23.05.2024—Taurus SA (“Taurus”), the European leader in digital asset infrastructure for banks and institutions, has partnered with SCCF, a Swiss trade finance expert, to execute a second trade finance transaction through a tokenized note instrument. This transaction was admitted for trading on the TDX regulated marketplace and attracted both Swiss and international professional investors.

Successful tokenization at the service of the real economy

Taurus is pleased to announce that SCCF, a Swiss-based trade finance expert founded in 2004, partnered with Taurus to issue, exchange, and redeem a note in the form of ledger-based securities on Taurus’ TDX marketplace, involving professional investors onboarded on TDX. The funds were used to finance a company involved in green energy.

The tokenized debt transaction took place between October 2023 and January 2024 and involved:

- SCCF, the issuer of the tokenized note.

- TDX, the marketplace to issue and trade the tokenized note.

- Professional investors onboarded on TDX who invested in the notes.

This “real” pilot transaction was a success, and SCCF and Taurus have agreed to further issue a series of other trade finance transactions within the next couple of months.

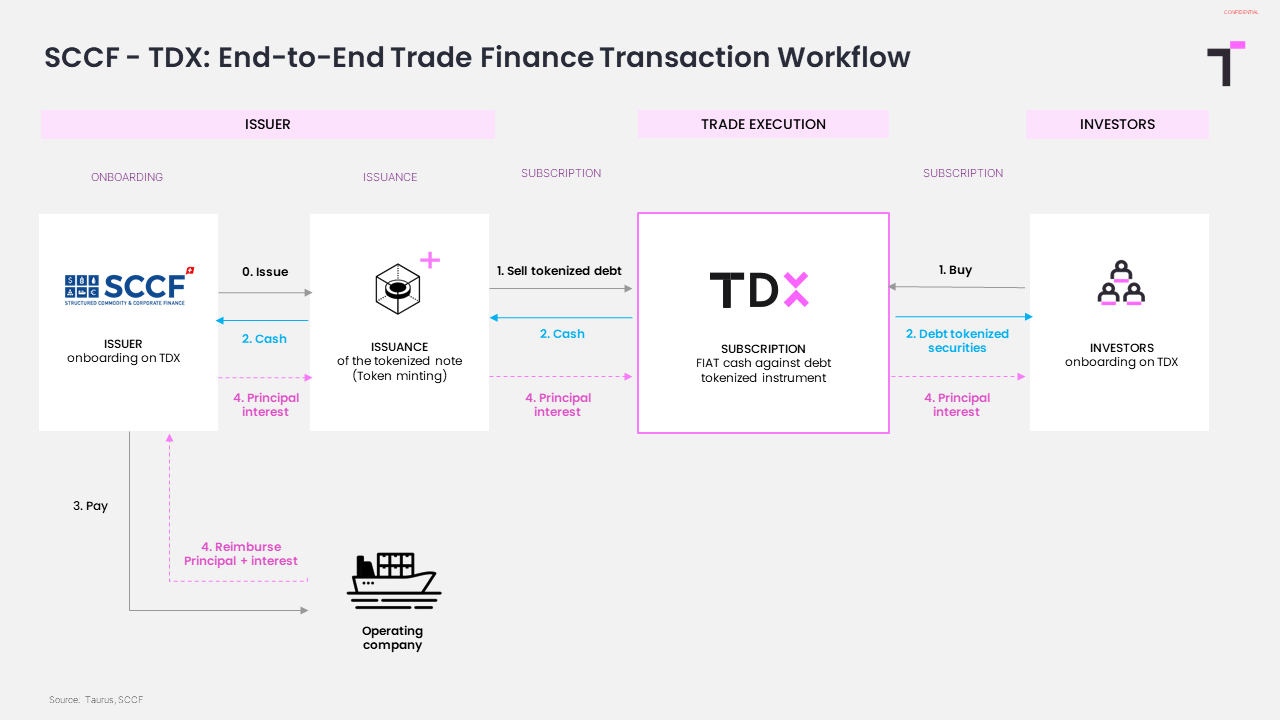

Structure of the notes and trading flows

The tokenization of the SCCF-2 note instrument was carried out pursuant to the standards established by the Capital Markets and Technology Association (CMTA) on the Ethereum blockchain. Taurus-CAPITAL, Taurus’ tokenization platform, was used to issue the smart contract, and Taurus-PROTECT, Taurus’ custody platform, was used to protect the smart contract private keys.

The subscription, exchange, and redemption of the SCCF-2 note were conducted on the TDX regulated marketplace and involved Swiss and international professional investors.

The note was a 3-month maturity loan issued in Euros. Interest payments were made in fiat currency. An evolution could be to pay the interest payments in Euro stablecoins, which TDX already supports. Further details are available in the figure below.

Dimitri Rusca, CEO of SCCF, says: “This is the second tokenized debt transaction we have conducted in real production conditions with third-party investors. The transaction was digitized and much simpler than in traditional trade finance environments, which are all paper-based. The use of blockchain technology also mitigates the risk of fraud and double financing. We will continue tokenizing debt instruments on TDX. Our ambition would be, in due time, to also have the cash leg on-chain to further optimize our processes and reduce costs at scale.”

Lamine Brahimi, Managing Partner and Co-Founder of Taurus, says: “The professional investors that subscribed to this tokenized debt transaction were pleased with the smooth process and returns they received. We look forward to further honing the flow with SCCF.”

Figure 1: Tokenized debt transaction lifecycle.

About SCCF

SCCF SA (Structured Commodities and Corporate Finance) Geneva was established 20 years ago by former major bankers specialized in commodity trade finance, it originates and provides commodity backed investment opportunities to small and mid-size commodity merchants. SCCF specializes in sourcing short to mid-term financing for companies active in the trading, production, processing, tolling, transportation, and distribution of essential commodities throughout the world. For further information on SCCF, please visit https://sccf.ch/

About Taurus

Taurus SA is a Swiss company, founded in April 2018, that provides enterprise-grade digital asset infrastructure to issue, custody and trade any digital assets: cryptocurrencies including staking, tokenized assets and digital currencies. With more than 60% market share in Switzerland, it is also the European leader in the banking segment, entrusted by the full spectrum of financial institutions: systemic banks, universal banks, online banks, crypto-banks, private banks, and broker-dealers. Taurus also operates a regulated marketplace for private assets and tokenized securities. For further information on Taurus, please visit https://www.taurushq.com